The age of AI enterprise applications… and consumer??

The mid-year edition of the Eniac Seed Sentiment Survey

by Dan Jaeck

What’s next for seed deals? While seed firms like Eniac are part of the larger VC ecosystem, we also represent a unique asset class that isn’t fully captured by reports and data that focus on the industry as a whole. That’s why we launched the Seed Sentiment Survey which we are conducting bi-annually. By reaching out to our counterparts who are actively deploying capital, we hope to provide insight into what’s actually happening in the earliest stage of investing.

For our third survey, we heard back from 48 investors, which we believe represents the general sentiment of the (U.S.) seed ecosystem. Our questions covered everything from AI, to follow-on financings, valuations, and more.

Here’s what stood out to us in the results, along with anonymous quotes from participants:

Seed investors are most focused on AI applications, as it’s the majority of their deal flow, despite general agreement that the category is overhyped. AI remains decisively the hottest category for seed rounds this year per our respondents, which is consistent with our last survey. Within AI, the application layer received the most votes as one of the top three hottest categories for seed investors (mentioned by 83% of respondents), followed by AI infrastructure (71%). Outside of AI there was a significant drop off, as vertical SaaS was the next most mentioned by only 31% of respondents. Where firms were actually spending their time roughly mirrored this, although notably vertical SaaS (42% of investors) edged out AI infra (29%) as a space of investor focus. The discrepancy between hype and investor focus for AI infrastructure is likely in part due to the barriers to entry for technical investing, nervousness around point solution consolidation capping upside, and greater capital requirements equating to larger genesis rounds (e.g., Skild AI’s recent $300mn financing).

Here at Eniac, many of the seed rounds in AI infra we saw last year are now considered features of larger platforms. This year we have primarily focused on AI applications that 10x user experience relative to what’s currently on the market (vs. what we deem as primarily incremental infrastructure improvements). This appears to be in-line with the majority of survey respondents.

“Most investors have similar takes (AI infra is overrated, vertical SaaS is interesting again, software eats services, etc).”

“I think dev tooling/AI infra has become very crowded and there are a lot of point solutions in the space. Security has the same feel, high valuations with little differentiation.”

“The hype around AI is the same, but in a different flavor. Investors are talking more about business model innovation, prior concepts that had tough unit economics might now work, etc. I think there’s a lot more creativity today leveraging AI and novel business models, far less chatbots and SaaS.”

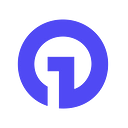

While AI applications are overwhelmingly the focus of most firms, there’s also agreement that that sector is overhyped; AI applications are by far the most overhyped category (60% of respondents) followed by AI infrastructure (14%). In addition, 46% of respondents expect AI hype to decrease (vs. 19% who expect it to increase). Some investors are now looking at previously out-of-favor categories — when asked which category investors should focus more energy on, the most mentioned was consumer (21%) followed by fintech & crypto (which collectively received 20% of responses). This is likely in part due to well-publicized up rounds/exits within these categories (e.g., Character AI & Google, Bilt Series C) and new potential applications in these sectors unlocked by AI. In addition, fintech, crypto, and consumer deals are likely to be done at lower valuation as they were also cited as the most out of favor sectors per our respondents.

“It’s easy to discount consumer, but there’s an important reset happening now. Foundational growth and companies focused on that are where we get excited.”

“There is a hidden potential within consumer AI applications, specifically, that has not fully bloomed. I believe we will see some of the fastest growing companies of the last decade in this sector within the next few years.”

“Fintech is coming back. There was a drought for the last 12–18 months, but there are many founders building in fintech again. Lots of pre-seed stage fintech companies. Lending in particular is overlooked.”

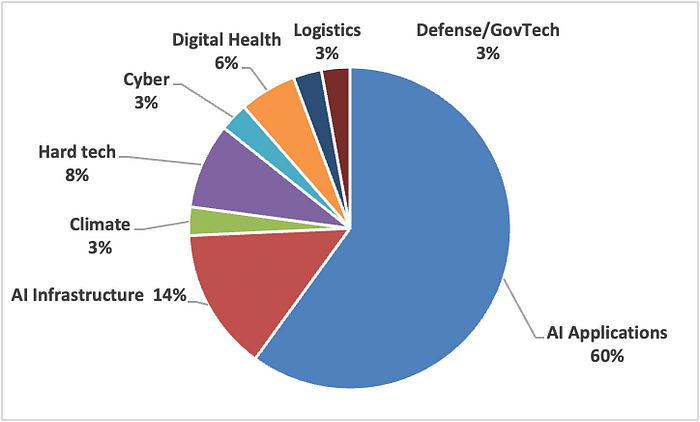

“Valuations in consumer are more palatable.”

The KPIs needed for AI applications to raise follow-on financing are increasing, causing general follow-on sentiment to worsen in 2024. The majority of respondents (62%) believe that Series A rounds are now more challenging to raise in 2024 relative to 2023. Carta’s data agrees with this sentiment as both Series A deal volume and dollars raised were down (22% and 15%, respectively) in 1H24 vs. the same time period a year ago. Some investors cited specific challenges for AI applications to raise Series A rounds given the difficulty in proving differentiation. Here at Eniac, we have found that Series A metrics have increased, specifically for AI applications, as follow-on investors are focusing more on GTM (e.g., expectations of $1.5mn+ of ARR with strong revenue momentum vs. $1mn ARR historically). This sentiment was highlighted by some investor anecdotes:

“The lack of competitive differentiation has made it very difficult for companies to raise A rounds so investors are more patient to wait to see the traction to support the winner in the category.”

“It’s all about speed to execution and rapid GTM cycles. Especially for apps, there’s very very little moat.”

There’s a bifurcation emerging around valuations of seed deals. Seed investors are seeing fundraises go either incredibly well or very poorly. Said differently, the seed rounds that are getting done are at high valuations. This sentiment is reinforced by Carta’s data, as 1H24 seed deal volume is down 18% year-over year, yet 2Q24 seed valuations surpassed 1Q22 levels (proxy for peak VC) for the first time since 2022. For context, on average our survey respondents are seeing pre-product deals (proxy for pre-seed) get done at ~$10.8mn post and ~$14.6mn post for a post-product company with $100k of traction (proxy for a seed deal); these are both directly in-line with our last survey in December.

“Significant bifurcation between the haves and have-nots. Rounds that have secured a lead can get “hot” really quickly, driving up valuations to astronomical levels, vs. there are many also perfectly good on paper companies that are struggling to raise.”

.It’s a total have and have nots market. People either struggle to raise and have to take bad valuations, or they are very coveted founders and raise at $20–30M like it’s still 2021.”

“It feels like the seed market is bifurcating. There are “reasonably priced” seeds that are getting done in disfavored sectors / smaller-TAM ideas, while hot founders in AI categories are raising pre-product/pre-revenue at $20–40M post. While this has always been true, the bifurcation seems more distinct than ever!”

“Companies led by serial entrepreneurs with large addressable markets still command significant valuation premiums. Companies with unproven founders or niche markets require more traction than ever at seed.”

“A with strong PMF still getting big valuations, preseed/seed generally inflated.”

“Wide variance between AI and non-AI, with significant premium for research-centric AI.

“It feels like round sizes are higher in SF than in NYC.”

One final note, Haize Labs was the hottest deal last quarter per our survey respondents with four mentions.

As always, including the raw stats from our survey below:

What is your current fund size?

At what stage does your fund invest?

What is the industry’s hottest sector(s) this quarter (choose up to 3)?

What is the industry’s most out-of-favor sector(s) this quarter (choose up to 3)?

What sector(s) is your firm most focused on this quarter (choose up to 3)?

In what sector(s) are you seeing the most deals (choose up to 3)?

Are there any sectors you personally think are currently overrated/overhyped?

What is underhyped? What should investors be more focused on?

What post-money valuation do you expect on average for a pre-product deal this quarter?

What post-money valuation would you expect on average for a deal with an MVP & $100k ARR this quarter?

Do you think seed investment valuations in 2024 (relative to 2023)…

In what geography are you doing the most deals?

In what geography are you seeing the most deals?

Do you think Series A rounds have gotten…

Do you expect hype around AI to…

What kinds of firms have you competed with the most to win seed deals?

Do you think the broader macroeconomic environment will improve or worsen in the remainder of 2024?

What was the buzziest seed deal this quarter?

Haize Labs (4x), Convoke Bio, Superpower, Mosaic, Promptfoo, Mandolin, Decisionly, Aerflo, Joy